Selected partners and customers

eSigning with maximum data security in online banking

Give your financial customers the opportunity to sign documents and contracts directly in online banking from the comfort of their own home. Save your employees and customers the hassle of post and long processing times. With maximum data security, as the documents do not leave your IT system and the eSigning tool has no access to the content.

Maximum data security

with Zero Document Knowledge Approach

No Audit cost

Two-Factor-Identification with Smarthpone passkey

No extra App download

Thanks to the use of passkey technology

“What you have developed is the next generation of eSigning, which is by far better than all the rusty certificate-based signing solutions regarding security, digital twin, life-cycle updates, and data privacy.”

Urs Fischer, Head of Business Development & Innovation, HIN AG

How your business can benefit

Here is how to supercharge your Financial Service business

Directly in online banking: convenient, digital signature processes for customers and employees

Digitize the banking processes of your customers and your team. Embed digital signatures easily and securely into your online banking and improve the signing process for everyone involved from A to Z.

Your team: Easy to use thanks to seamless integration into existing systems via a simple, powerful API

Your customers: Direct signing from anywhere thanks to immediate provision of the documents to be signed in online banking

Seamless identification for all signatories without media breaks

Legally compliant and user-friendly

Maximum data protection through zero document knowledge

Documents and data are processed by the customer and never leave your own IT environment. Unlike the competition, Certifaction has no insight into the content of your documents.

No insight into document content

Documents locally processed on customer side

Complete end-to-end encryption

Banking secrecy preserved

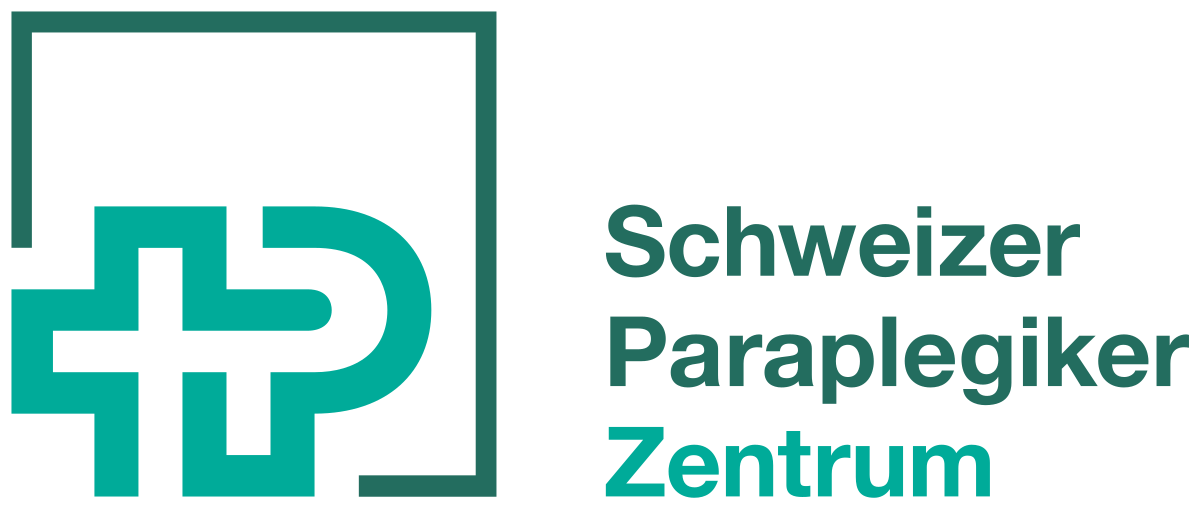

See Certifaction in Action

Click through the initiation of a signature request

eSigning Features for banks and the financial sector

QES and SES in eBanking app

- Sign directly within the eBanking app using the QES or SES and carry out the necessary identification.

Digital Onboarding

- Your employees and users can take part in a fully digital, remote onboarding process.

- Users can also go through your onboarding on site, for example in the branch.

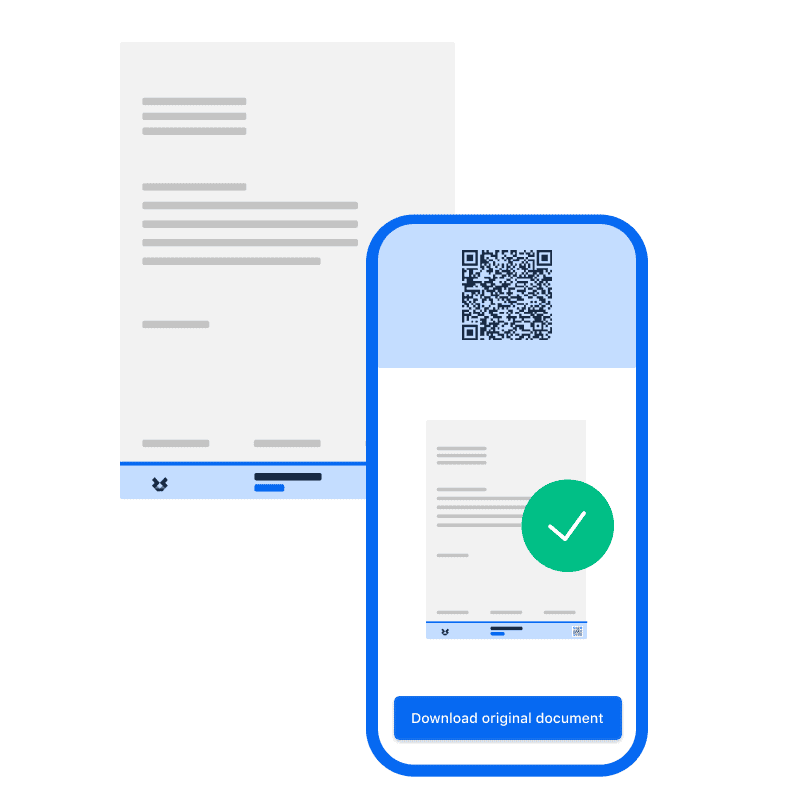

Digital Twin

- Bridge between printed documents and their digital originals

- By scanning the QR code, you can immediately see the digital original on the screen and check its authenticity.

One shot and recurring signing

- Signatories can identify themselves once for a single signature.

- Regular signatories can identify themselves once for repeated signatures.

Mass signing

- Request signatures for multiple documents at once in an efficient workflow.

- The invited signatories can sign all or selected documents at once.

Form filling

-

Insert your PDF forms and distribute them to your signatories.

-

You and your signatories fill in the individual fields before signing.

Customized

branding

- Certifaction can be fully whitelabeled to fit into the look and feel of your own brand.

Selective Signing

- Invited signatories can sign individual documents within the mass signature and not others.

Password protection

-

Automatically generate a strong password for your documents before uploading them to Certifaction.

-

Benefit from the unrivaled security of end-to-end encryption and local processing – neither Certifaction nor our partners have any possibility to access your documents.

Comply with legal and regulatory requirements

Whether digital signature or identification process: Meet the legal standards for eSignatures and authentication.

Comply with the strictest regulatory and security requirements of Switzerland, the EU, and all major global standards (incl. eIDAS, ZertES, UETA, ESIGN)

All signature standards (EES, FES, QES)

Unique identification, confirmed by a trust service provider

incl. GWG-compliant identification (for Switzerland)

Verify your documents – even when printed

Still need to print? We’ve got you covered.

Only with Certication: Easily verify your documents even when printed

Keep your documents always traceable, verifiable, and downloadable

Choose to store your documents digitally and/ or in paper form

Why Certifaction

Your Benefits: Flexibility, proximity and customer satisfaction

Rely on us as a local partner from Switzerland, because we know the local laws and regulations. Our team responds quickly and agilely to customer requests and implements new features rapidly. An NPS of more than 90 testifies to our many happy customers.

Bulk Signing

Regulatory-compliant

Legally valid

Zero-Document-Knowledge

FAQs

Here are the answers to the most frequently asked questions

How is Certifaction different to simple PDF solutions?

The biggest difference is that Certifaction doesn’t rely on simple PDF solutions that have been manipulated and hacked time after time:

- You benefit from blockchain’s superior security has no single point of failure and is virtually impossible to hack.

- You stay in full privacy control, with a solution that is built on privacy-by-design, where your documents don’t have to be uploaded to the cloud but can be locally processed on your device.

In addition, your documents can be instantly verified – in an intuitive way that doesn’t require an instruction manual. And thanks to our Digital Twin solution, you can now also verify printed documents – on any smartphone – and download their digital originals.

Are Certifaction's eSignatures legally valid?

Yes. Our blockchain-based eSignatures are legally valid and support all major global standards (incl. eIDAS, ZertES, UETA, ESIGN).

In addition, you can select the right signature type for your needs: from our cost-effective blockchain eSignature all the way up to qualified blockchain eSignatures (QES).

And did we already mention that they come with a full audit trail that is immutable?

Will my documents be uploaded to the cloud?

No, not necessarily: Certifaction is built on privacy-by-design. This means that all documents can be locally processed on your device – or, if they need to be shared via the cloud (e.g., for eSignature invitations or the Digital Twin), then they are protected with end-to-end encryption and hosted on ISO 27001 certified servers in Switzerland. And as an Enterprise customer, you also have the option to host your documents on your own server.

Is it free to verify a document?

Yes. The verification of both your electronic & printed documents is free.

And did you know that you could also make our verification tool your own (on the Enterprise plan) and embed it in your own web page?

Can I keep my branding throughout the whole process?

Yes, in our Enterprise plan. There you have the option to customize the branding of all signing, certifying, and verifying processes and stay within your brand identity. That also includes our WebApp and your document footers.